Sustainable Cultural Tourism

Business Model Description

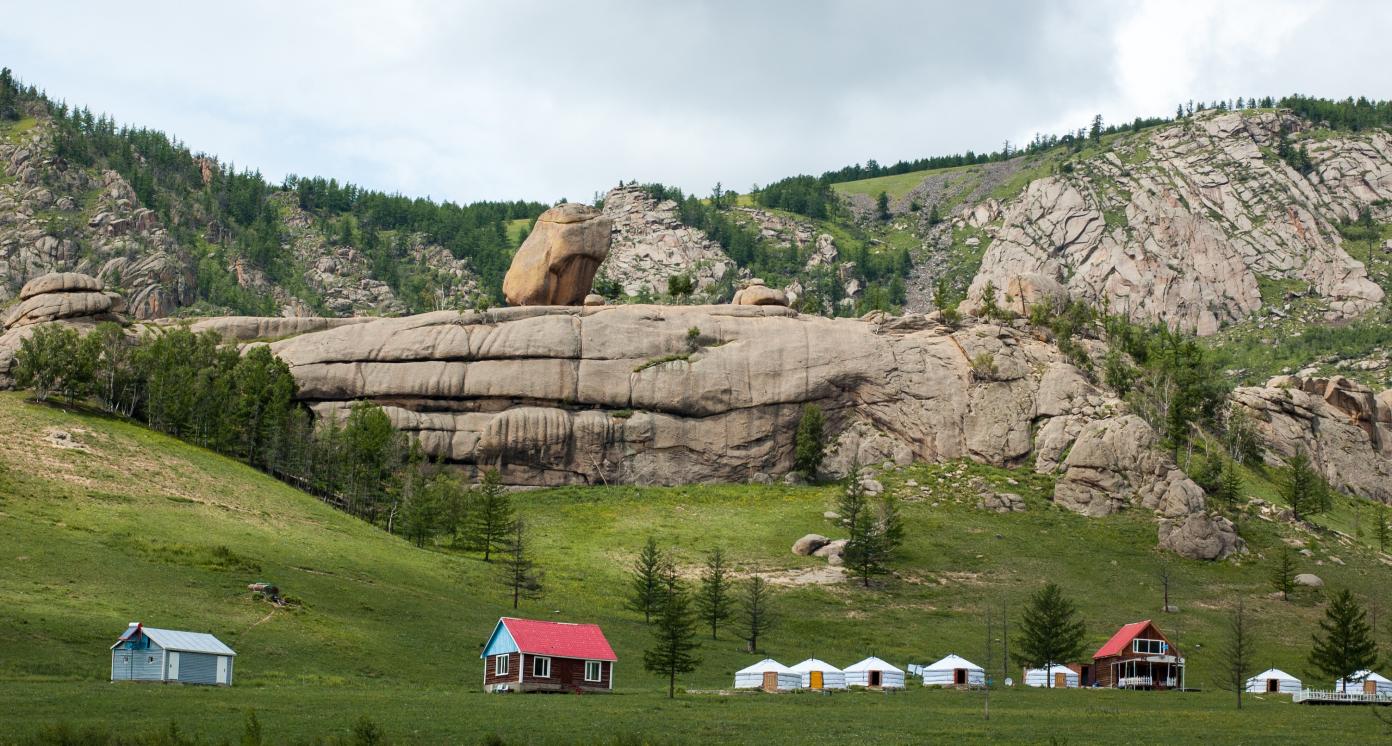

Invest in sustainable and cultural tourism, including the construction and operation of infrastructure and services that are environment friendly and rely on local value chains and communities such as the herder families. Examples of companies active in this space are:

"A boutique Ger” is a tour product between six tour operators and local communities, while Ger-to-Ger has developed several community products in its own chains. 15 percent -20 percent of the package income is retained within the community. Also, local travel suppliers, mostly via tour camps, transport drivers, guides and even NGOs, attach nomadic tourism products with their services. (2)

Felt-making festivals are organized by three travel camps, namely Sweet Gobi Geolodge, Tsaidam Camp and Munkh Tenger, and 6 percent-10 percent of their profits go to the community for each product. (2)

Expected Impact

Promotion of sustainable tourism practices to increase jobs in tourism potential areas, reduce environmental damage and conserve local heritage.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Mongolia: Khentii

- Mongolia: Khuvsgul

- Mongolia: Arkhangai

- Mongolia: Bayan-Ulgii

- Mongolia: Umnugobi

- Mongolia: Uvurkhangai

- Mongolia: Uvs

Sector Classification

Services

Development need

Mongolia has a small, but rapidly growing tourism sector. In 2019, tourism accounted for 7.2 percent of Mongolia’s GDP, generating USD 989.2 mn, 7.6 percent of total employment and 88,500 jobs, however, tourism sector has been adversely affected by COVID-19 which led to a decline in the number of international tourists by 90-95 percent during the COVID-19. (1)

Policy priority

Under Vision 2050, Mongolia aims (1.2) to become a leading country with preserved nomadic civilization, based on the national mentality, heritage, culture and mindset, and centered around the creativity of Mongolian citizens. Government plans to expand tourism and focus on the country's protected areas, which encompass 21percent of Mongolia's area and aim to reach 30 percent by 2030.

Gender inequalities and marginalization issues

According to the statistics of 2019-2021, women represent 70 percent of total employees working in the hospitality industry (4).

Investment opportunities introduction

Development of the tourism sector is accorded a high national priority to diversify the economy and create jobs, especially under Mongolia's current economic difficulties (1).

Key bottlenecks introduction

Operational issues for tourism sector include low quality of service provision, inadequate infrastructure, as well as a short duration of tourism season due to harsh winters in the region. Limited number of international flights, high airfare costs during the peak season also hinder the growth of tourism industry in Mongolia.

Hospitality and Recreation

Development need

Most tourism sites are underfunded by the government budget and located in remote regions with high poverty levels. Tour camp development around the protected areas is increasing rapidly, however, the tourism sites are becoming polluted due to inadequate infrastructure, transport and sanitation, and communities receive few benefits from tourism. (1)

Policy priority

The State Policy on Tourism Development, the National Program on Tourism Development (2016–2030) and the Government Action Plan aim to implement the "Sustainable Tourism Development Project" in 7 provinces and develop cultural tourism sites in Chingis Khan's birth place and other historic destinations.

Gender inequalities and marginalization issues

Nomadic herders make their living by herding horses, camels, goats, cattle and sheep for milk, cashmere, meat and other livestock products. Thus, maintaining a steady income is a challenge for them since the region is prone to severe climate, i.e. freezing winters and extremely dry summers.

Investment opportunities introduction

From 2015 to pre-COVID-19 in 2019, the tourism industry's revenue increased by 219%. By 2030, the tourism sector is forecasted to contribute 11 percent (USD 1.5 bn) of GDP, provide 95,000 jobs, and attract 1 mn international arrivals annually. (1)

Key bottlenecks and challenges include loss of control over solid waste and sanitation, inconsistent standards at tour camps, unregulated access and camping and weak capacities for managing tourism growth.

Leisure Facilities

Pipeline Opportunity

Sustainable Cultural Tourism

Invest in sustainable and cultural tourism, including the construction and operation of infrastructure and services that are environment friendly and rely on local value chains and communities such as the herder families. Examples of companies active in this space are:

"A boutique Ger” is a tour product between six tour operators and local communities, while Ger-to-Ger has developed several community products in its own chains. 15 percent -20 percent of the package income is retained within the community. Also, local travel suppliers, mostly via tour camps, transport drivers, guides and even NGOs, attach nomadic tourism products with their services. (2)

Felt-making festivals are organized by three travel camps, namely Sweet Gobi Geolodge, Tsaidam Camp and Munkh Tenger, and 6 percent-10 percent of their profits go to the community for each product. (2)

Business Case

Market Size and Environment

> USD 1 billion

Before the COVID-19, tourism accounted for 7.2 percent of Mongolia’s GDP, generating USD 989.2 mn. (1)

During 2015-2019, the tourism industry's revenue increased by 219 percent (1). The travel and tourism industry’s total contribution to Mongolia’s GDP is expected to reach more than USD 2 bn by 2028 (up from USD 1.23 bn in 2017). In comparison, outbound trips in neighbouring markets like China, Russia, South Korea, and Japan, are on the rise.

The international visitor surveys in between 2015 to 2019 showed that most of the activities that tourists preferred were directly linked with nomadic tourism products and services, including Ger-stay experience (Mongolian traditional dwelling-based camps), horse and camel riding, daily life-cultural experience products and nomadic festivals and events. (2)

Indicative Return

> 25%

Businesses in the sector provide not only services for tourists, but also for locals who use neighborhood restaurants and entertainment venues. In 2019, 577,300 people arrived in Mongolia and tourism revenue reached USD 607.2 mn.

If herder households sell their nomadic tourism products and services through Local Tourism Coordinators with an initial investment of USD 2100, the herder family will be able to work for at least 53 days during the summer season and begin to benefit from having 100% operation. The Local Tourism Coordinator will earn 10% of the fee from the service. The average cost per tourist is USD 2,048. (2)

According to the ADB’s Sustainable Tourism Project estimation, an investment of USD 7350 for a tourist camp will enable the business to increase its revenue by 25 percent while an investment of USD 2600 will help Ger camps (Mongolian traditional dwelling-based camps) to increase the revenue by 96 percent. (1)

Investment Timeframe

Short Term (0–5 years)

According to the UNDP's Report, nomadic tourism products of local travel suppliers will have a breakeven point at 62 days with an initial investment of USD 2100. (2)

Ticket Size

< USD 500,000

Market Risks & Scale Obstacles

Business - Supply Chain Constraints

Market - Volatile

Market - High Level of Competition

Impact Case

Sustainable Development Need

Sustainable and cultural tourism products can accelerate the rate of economic growth. The global spread of COVID-19 in 2020 resulted in national border closures in Mongolia, the decline - to almost zero - of international arrivals, and estimated losses in tourism revenue over USD 421 mn. (3)

Unmanaged tourism activities have an impact of environment and culture, including loss of control over solid waste and sanitation, inconsistent standards at tour camps, unregulated access and camping and weak capacities.

Gender & Marginalisation

Most of nature and cultural heritage-based tourism sites are underfunded and located in remote regions of high poverty where the rural population livelihood is dependent on pastoral livestock and subsistence agriculture.

Sustainable and cultural tourism will benefit local communities through diversified income opportunities of selling their products and services directly to tourists as well as new employment. The average monthly income of USD190 was generated by one surveyed household, and income from tourism-related activities accounted for 13-14 percent. (2)

Women in rural areas face limited employment opportunities. A very small number of women benefit from employment and/or income from the tourism sector, and most of such employment comprises low-skill jobs such as cleaning and cooking with low salaries.

Women have the potential to increase their involvement in the selling of agriculture products (e.g. food and dairy items) and handicrafts to tourists and tour companies but require capacity building to benefit fully from tourism-related opportunities.

Proper waste disposal and sanitation systems can help ensure a clean living environment for the population, especially women and girls who are disproportionately vulnerable to the harmful impact of pollution from chemicals and waste.

Expected Development Outcome

Sustainable and cultural tourism supports responsible consumption practices through resource efficiency, recycling, usage of renewable resources and energy-efficient equipment, as well as supply from local food producers.

Sustainable and cultural tourism projects promote the protection of the environment and the promotion of local cultures through awareness raising and improving knowledge about the protection of the planet and traditions.

Herder communities will actively protect their land from degradation and could enhance conservation efforts through the income generated from tourism.

Gender & Marginalisation

Reduced inequality between urban and rural regions, by improving the required infrastructure for sustainable and cultural tourism.

Primary SDGs addressed

8.9.1 Tourism direct GDP as a proportion of total GDP and in growth rate

7.2 percent - to reach 2019 levels (6)

By 2030, the tourism sector is forecasted to contribute 11 percent (USD 1.5 bn) of GDP, provide 95,000 jobs

12.b.1 Implementation of standard accounting tools to monitor the economic and environmental aspects of tourism sustainability

Not implemented. The number of tourist visited Mongolia was 577,200.

Implemented. The target number of tourist is 1 mn by 2025 and 2 mn by 2030.

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Indirectly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Outcome Risks

Pandemics and disease outbreaks result in travel restrictions which lead to a decline in tourism.

Lack of financial resources and training will limit or discourage community participation in the tourism development process, which is crucial to the success of sustainable and cultural tourism.

Gender inequality and/or marginalization risk: Increased tourism activities around rural communities might disrupt local communty's lifestyle, including herding, dairy production, milking, etc.

Impact Risks

Some communities may not be experienced with the best practices for environmental management and sustainable and cultural tourism, thus undermining the effectiveness of the IOA.

Untrained employees might worsen the quality of services.

External private tourism operators may not involve local communities in the tourism business, that will limit the scale of the IOA.

Gender inequality and/or marginalization risk: Without financial support, rural households may face challenges in starting tourism business, thereby limiting the scale of the IOA.

Impact Classification

What

Promoting sustainable and cultural tourism to reduce the economic and environmental impact of conventional tourism and increase the income of rural communities.

Who

Communities based in tourism destinations benefit from new sources of employment and income, as well as reduced environmental degradation.

Risk

Sustainable and cultural tourism is a proven model that supports sustainable development, but the increased number of tourists can create environmental hazards.

Contribution

As of 2019, tourism accounted for 7.2 percent of Mongolia’s GDP, generating USD 989.2 mn, 7.6 percent of total employment, and 88,500 jobs.

How Much

As of 2022, there are 246,302 herder households who can potentially benefit from sustainable and cultural tourism.

Impact Thesis

Promotion of sustainable tourism practices to increase jobs in tourism potential areas, reduce environmental damage and conserve local heritage.

Enabling Environment

Policy Environment

The National Program on Tourism Development, 2016–2025, outlines a phased approach that prioritizes investments in visitor facilities, transport and sanitation infrastructure, and community-based products and services.

The Mongolian Government has declared 2023 and 2024 as “Years to Visit Mongolia” to promote the country’s pandemic-hit tourism sector. Within this framework, the country aims to receive up to "1 million" tourists a year in Mongolia. To promote Mongolia abroad, an online platform named 'mongoliatravel.guide' is being developed.

The Strategic Plan for Recovering Tourism Sector: Inbound Tourism 2022-2024, approved by the Ministry of Environment and Tourism, includes a strategic plan to recover the tourism sector after COVID-19.

Under the tourism Strategic Plan, the Ministry will implement a number of activities including promoting the tourism sector to international tourists, exempting tourism companies operating in rural areas from licensing requirements until 2024, providing waivers in terms of employees’ social insurance payments and taxation until 2024, granting concessional loans, and providing green and safe tourism certifications, etc.

Financial Environment

Financial incentives: According to the Government decision of November 2022, a subsidized loan program will be implemented to support tourism sector for 2 years.

Fiscal incentives: The Government of Mongolia has submitted the Revised Law on Tourism to the Parliament which includes the exemption of tourists from VAT, facilitation of visa granting process as well as liberalization of air transportation to cancel the restriction of air flights to Mongolia.

Other incentives: Several commercial banks are offering concessional loan services for herder households to reduce environmental pollution and promote environmentally friendly consumption of citizens. This program offerer loan rate is at 3-8% per year to promote tourism products.

Regulatory Environment

The Law on Tourism regulates relations between the State, citizens, economic entities and organizations with regards to tourism promotion, engagement in tourism activities and provision of tourism services on the territory of Mongolia.

Environmental protection law approved in 2005, and updated in 2012, legalizes rights and duties of citizen partnerships, professional organizations, and NGOs to participate in environmental protection measures.

The Law on Land currently regulates spatial planning in Mongolia (issued and approved by the Parliament of Mongolia in 2002).

The Law on Special Protected Areas is to regulate relations concerning the utilization of and taking areas under special protection, preservation and protection of natural landscapes and historical and cultural sites and natural sightseeing.

Marketplace Participants

Private Sector

Corporates: Nomadic Expeditions LLC, Nomads LLC, Nomadic Journeys LLC, Nomadic ways LLC, Nomadic Planet LLC, Nomad Holiday LLC, Discover Mongolia Travel LLC;

Government

The Ministry of Environment and Tourism, Mayor of Provinces and Local Governments

Multilaterals

Asian Development Bank, United Nations Development Program, World Bank, Japan International Cooperation Agency, European Bank for Reconstruction and Development

Non-Profit

The Nature Conservancy, Association of Tourism of Mongolia, Sustainable Tourism Development Center, Mongolian Tourist Guides Association, Tourism Council of Mongolian Chamber of Commerce

Public-Private Partnership

Mongolian National Chamber Of Commerce And Industry (MNCCI)

Target Locations

Mongolia: Khentii

Mongolia: Khuvsgul

Mongolia: Arkhangai

Mongolia: Bayan-Ulgii

Mongolia: Umnugobi

Mongolia: Uvurkhangai

Mongolia: Uvs

References

- (1) Asian Development Bank. (2021). Sector Assessment Summary. https://www.adb.org/sites/default/files/linked-documents/51422-002-ssa.pdf

- (2) United Nations Development Programme (UNDP). (2021). The Concept on Ger and Nature Scheme for Nomadic Tourism in Mongolia

- (3) National Statistics Office of Mongolia (NSO). (2022). Employment by classification of economic activities, sex, age group. https://1212.mn/mn/statistic/statcate/573055/table-view/DT_NSO_0400_035V7

- (4) World Travel & Tourism Council. (2019). Travel & Tourism Economic Impact 2018 Mongolia

- (5) National Statistics Office of Mongolia (NSO). (2023). Number of entities registered by group of economic activities and activity status. https://1212.mn/mn/statistic/statcate/573067/table-view/DT_NSO_2600_016V3

- (6) Ministry of Environment and Tourism. Strategic plan of the Ministry of Environment and Tourism for inbound tourism recovery